- Texas Real Estate News

- Posts

- Fed Chair Powell signals another rate cut

Fed Chair Powell signals another rate cut

Plus: Austin is America’s #1 move-easy metro

👏 Cheers to baby Friday!

Today’s newsletter is 667 words, a 3-minute read.

1. Austin is America’s #1 move-easy metro

According to RentCafe, Austin ranks as the nation’s #1 “move-easy” metro, with more than 50% of its renters relocating to a different apartment within two years between 2018 and 2023, compared to the national average of 38%.

Gen Z renters are the most mobile, making up 72% of movers in their age group, while 43% of Millennials, 27% of Gen X, and 20% of Boomers switch apartments within two years.

Source: RentCafe

2. Texas tops the list of investor-owned properties

Investors purchased 33% of all single-family homes sold in Q2 2025 — up from 27% in Q1 and marking the largest share since 2020, according to a BatchData report. Overall, the report shows that investors now own about 20% of the nation’s 86 million single-family homes.

Texas leads the pack with 1.46 million investor-owned properties, followed by California with 1.33 million and Florida with 1.1 million.

Small investors (those owning 10 properties or fewer) now control over 90% of investor-owned homes, focusing on lower-priced properties averaging $455K, while large landlords are targeting the Midwest and South with average purchases near $280K.

A MESSAGE FROM SUPERHUMAN AI

The Gold standard for AI news

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team

3. Catch up quick

🚀 Central Texas housing market posts largest gain in closed sales. (unlockMLS)

⚠️ Federal firings could reach 10,000 during shutdown. (Axios)

🎈 HomeSmart celebrates 25 years with new branding. (HousingWire)

😟 Nearly half of U.S. States are in or near recession. (Realtor.com)

A MESSAGE FROM DAVE YOUR MORTGAGE GUY

It’s okay you can admit it, the worse feeling is having that Mortgage Related Question at 2am! It will keep you up all night. Most Loan officers work 9-5, not me I got your back 24hrs.

Tune in for my hilarious video on why you need the Ask Dave App!

Get the App Now!

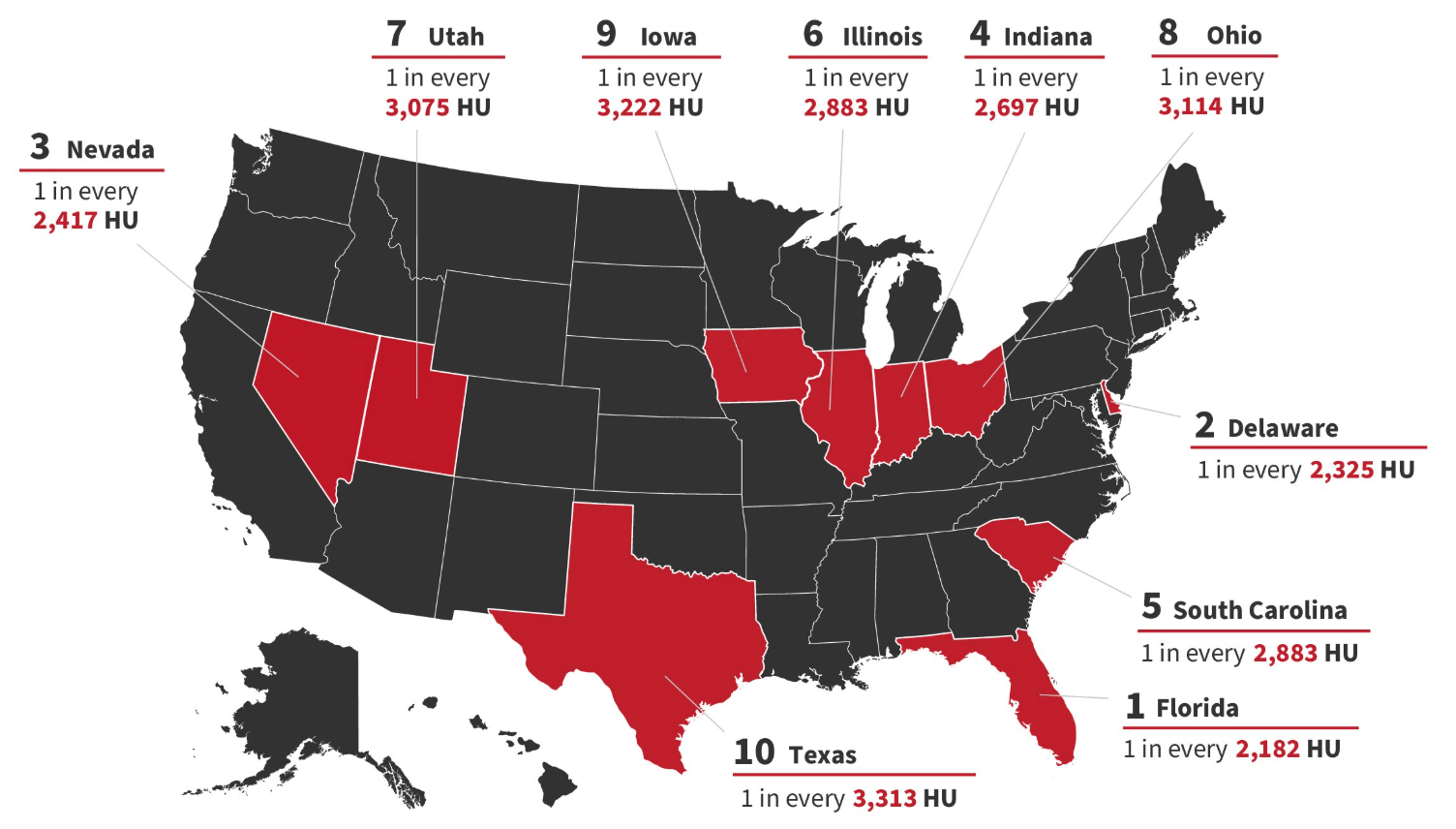

4. Texas among the states with the highest foreclosure rates

According to ATTOM’s latest report, foreclosure activity across the U.S. was down 0.3% in September compared to August, but up 20% from a year earlier. A total of 23,761 properties began the foreclosure process in September 2025 — down 2% month-over-month but up 20% year-over-year.

Texas ranked 10th nationwide for foreclosures, with 1 in every 3,313 housing units (3,589 filings out of 11,890,808 units) entering foreclosure.

Source: ATTOM’s Foreclosure Data

5. Austin is now the most affordable rental market

According to a report from Realtor.com, the median asking rent for 0–2 bedroom properties across the nation’s 50 largest metros fell to $1,703 — a 2.1% drop from a year ago and $10 less than the previous month.

This marks the 26th consecutive annual decline and the second monthly dip since March, signaling a sustained cooling in the rental market.

Additionally, Austin has overtaken Oklahoma City as the most affordable major rental market in the country. In September, Austin renters with a typical household income spent just 16.5% of their income on rent, down from 19.3% a year earlier.

6. Fed Chair Powell signals another rate cut

Federal Reserve Chair Jerome Powell signaled that the central bank is on track to deliver another quarter-point interest rate cut later this month, even as a government shutdown limits its ability to assess the economy.

Speaking Tuesday at the National Association for Business Economics annual meeting, Powell said the economic outlook appeared largely unchanged since policymakers met in September, when they lowered rates and projected two more cuts this year.

The Fed’s September move — cutting the target range to 4–4.25% — was its first since December and followed a sharp slowdown in summer hiring. Still, unemployment has remained relatively low, ticking up to 4.3% in August.

The Fed is scheduled to meet again on Oct. 28–29.

A MESSAGE FROM MONEY.COM

Get home insurance that protects what you need

Standard home insurance doesn’t cover everything—floods, earthquakes, or coverage for valuable items like jewelry and art often require separate policies or endorsements. Switching over to a more customizable policy ensures you’re paying for what you really need. Use Money’s home insurance tool to find the right coverage for you.

☀️ Thank you for starting your day with us!

If you like this newsletter, your friends may too. Forward it to a friend, and let them know they can subscribe here.

Interested in advertising to 50k+ Texas Realtors? Email [email protected]