- Texas Real Estate News

- Posts

- NAR sees existing-home sales rise slightly in July

NAR sees existing-home sales rise slightly in July

Plus: Trump orders removal of Fed Governor

😄 Welcome back! Let’s Tuesday together. Today’s newsletter is a 2.5-minute read.

1. Trump orders removal of Fed Governor

President Trump on Monday said he had fired Federal Reserve Governor Lisa Cook, according to a letter posted on his social media. It’s the first time in the Fed’s 111-year history that a president has dismissed a central bank governor.

The move escalates Trump’s clash with the Fed, which he has accused of acting too slowly to cut interest rates.

Trump claimed there was “sufficient reason” to believe Cook had made false statements on mortgage agreements, and cited constitutional powers which he said allowed him to remove her.

“President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so. I will continue to carry out my duties to help the American economy as I have been doing since 2022.”

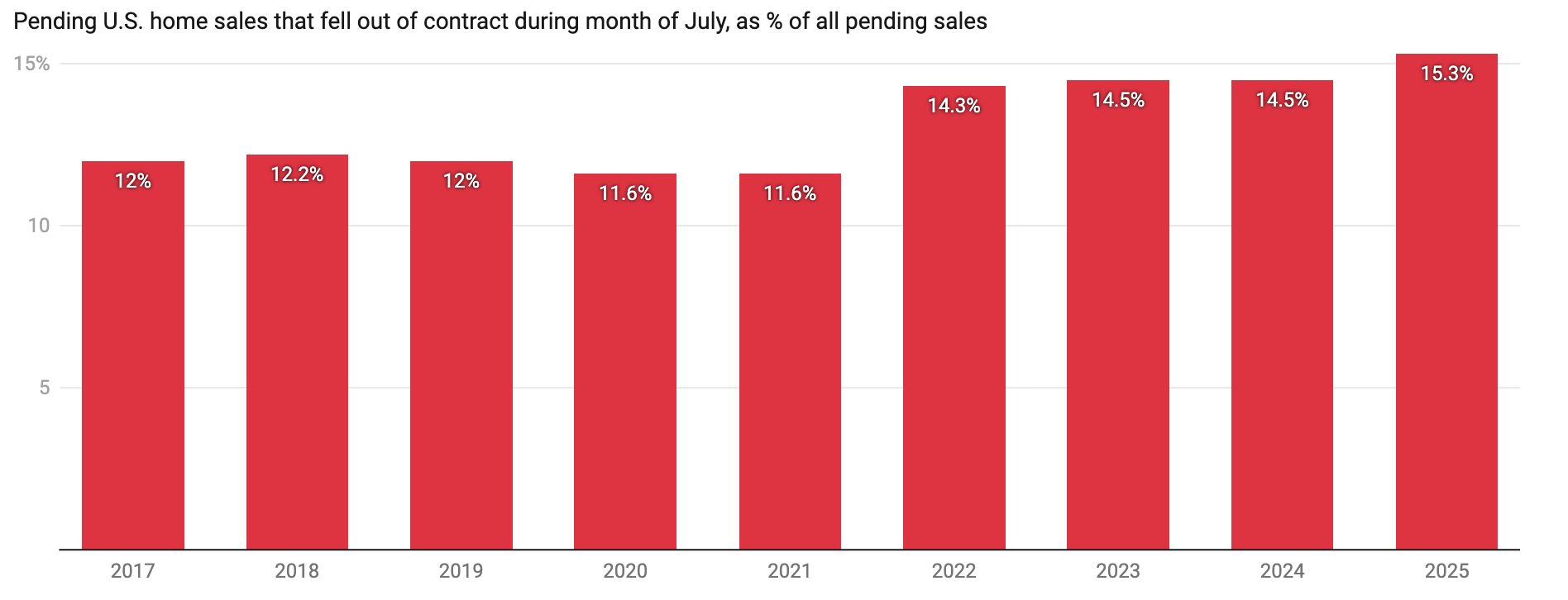

2. Homebuyers canceled contracts at a record pace in July

Roughly 58,000 home-purchase agreements fell through in July, according to new Redfin data. That’s 15.3% of homes that went under contract—up from 14.5% a year earlier and the highest July rate since records began in 2017.

San Antonio led the nation with 730 cancellations in July, equal to 22.7% of pending sales—the highest share among all metros.

Source: Redfin

A MESSAGE FROM DAVE YOUR MORTGAGE GUY

Best Dam Down Payment Assistance Program

Most down payment assistance programs sound great—until your buyer gets denied because of income limits or neighborhood restrictions.

Mine is different!

✅ No income limits – Works for high earners and first-time buyers alike

✅ No location restrictions – Buy anywhere

✅ More buying power – Up to 4% of the sales price to cover down payment, closing costs, or rate buydown

✅ Higher DTI allowed – Approve more buyers who were previously sidelined

This is the kind of flexibility that can help you get more folks in homes! Tune in for the details.

3. Catch up quick

📦 Austin realtor launches Texas move-out service. (Axios)

✍️ 44% of U.S. workers are delaying or canceling home purchases. (Redfin)

📈 Short-term rental demand hit a record high in July. (AIRDNA)

🏘️ Older adults support changing zoning laws to make homebuilding easier. (AARP)

🍽️ Millennials, Gen Z renters skip meals to afford rent. (Redfin)

A MESSAGE FROM SUPERHUMAN AI

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

4. NAR sees existing-home sales rise slightly in July

According to the latest update from NAR, in July, sales of existing homes rose 2% month over month, defying the predictions of many experts who expected a decline, reaching a seasonally adjusted annual rate of 4.01 million units, 0.8% higher than in July 2024.

Here are the other key data points from July:

Inventory climbed 15.7% YoY to 1.55 million homes, the highest level since May 2020.

The median home price hit $422,400, up just 0.2% YoY, but still a July record.

Homes averaged 28 days on market, up from 24 days a year ago.

Sales of homes over $1 million rose 7.1%, those between $100K–$250K dipped 0.1% and those under $100K fell 8%.

The market now has a 4.6-month supply of homes, short of the 6-month threshold for a balanced market, but still an improvement.

Related News: New-home sales fell to 652,000 units in July, down 0.6% from June and 8.2% from a year earlier, according to Census Bureau data.

5. Investors own almost 900,000 vacant homes

Investors held more than 882,300 vacant houses as of last year’s third quarter, according to a new ATTOM report. That’s just 3.6% of the 24.9 million investor-owned properties nationwide—but a big share of the nearly 1.4 million total residential properties sitting empty at the end of September 2024. It’s also nearly triple the 1.3% of all U.S. homes that are vacant.

The report also shows that 222,318 properties were in foreclosure during Q3. Of those, about 7,500—3.4%—were “zombie” homes that had been abandoned by their owners. That’s a slight uptick from the previous quarter, when 3.3% of pre-foreclosure properties were zombies.

“Vacant and zombie homes can hurt the value of surrounding properties and start a negative spiral in a local housing market. While we’ve seen the rate of zombie homes tick up a tiny bit this quarter, the overall rate of vacant homes and homes in the foreclosure process has remained remarkably steady.”

A MESSAGE FROM PACASO

Former Zillow exec targets $1.3T

The top companies target big markets. Like Nvidia growing ~200% in 2024 on AI’s $214B tailwind. That’s why the same VCs behind Uber and Venmo also backed Pacaso. Created by a former Zillow exec, Pacaso’s co-ownership tech transforms a $1.3 trillion market. With $110M+ in gross profit to date, Pacaso just reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

☀️ Thank you for starting your day with us!

If you like this newsletter, your friends may too. Forward it to a friend, and let them know they can subscribe here.

Interested in advertising to 50k+ Texas Realtors? Email [email protected]